How To Make A Small Business Budget

October 13th, 2022

Any successful business has a business budget.

For your small business, it is crucial that you have a business budget in place. A business budget is a spending plan for your business based on income and expenses. This helps you keep costs under control and grow revenue instead of spending all of it. A business budget also helps you identify your available funds, an estimate of business expenses, and will give you a prediction of how much money your business will need in the future.

When you build a business, it can be hard to stay on top of everything needed to start it up. From finding new clients to marketing your small business, a business budget can sometimes be put on the back burner. This can be the solid reason as to why your small business creates debt. A business budget can help your small business cut down on unnecessary expenses. Therefore, with the right business budget, you can help your small business stay out of debt and find ways to help you reduce your current debt.

So, let's get started on how you can create the perfect budget for your small business!

Which Is Right For Me?

Although it can seem easy to dive into creating a business budget, first you need to identify which budget is right for you and your business revenue goals.

1. Master Budget

A master budget is made up of all of the lower-level, specialized budgets. This includes; sales budget, production budget, labor costs, costs of goods budget, selling expense budget, administration budget, and more.

A master budget combines all of the smaller budgets within your business and turns them info one overall budget. These inputs from the financial statements to budget and plan activities that your business needs to achieve your business goals.

After this budget is reviewed by multiple managements, it can then be reviewed for the final time allowing funds to be processed and distributed.

2. Operating budget

An operating budget displays a business’s anticipated and anticipated expenses and revenue for a specific period of time. This report consists of fixed costs, variable costs, capital costs, and non-operative expenses.

This budget is a high-level summary report that includes line items backed up with relevant details. This is how this budget operates to track business spending.

This budget is constantly updated throughout the year on a monthly or quarterly basis.

3. Cash budget

Cash flow budgets give you an estimate of money coming in and going out of a business for a certain amount of time. These budgets are created by sales forecast and production by estimating accounts payable or receivable.

The estimations from this budget can help you predict if you have enough liquid cash for operating, if your money is being used productively, and if your profit will outweigh your business costs.

4. Financial Budget

This budget consists of a draft to estimate the capital needed and at what time frames it will need to be fulfilled by. These time frames could be long-term or short-term. There are factors in assets, liabilities, and equity that can affect components of this sheet. This budget gives you an overall idea of your business’s health.

5. Labor Budget

This budget is ideal for any business which plans to hire employees to achieve meeting projection or inventory goals.

A labor budget helps you determine the number of employees needed to achieve your goals so that you can plan the estimated cost for your projected employees.

This also helps you plan for seasonal employees if your business plans on hiring them.

6. Static budget

Static budgets are an estimate of revenue and expenses that will remain fixed through the year. These expenses in the budget can be used as goals to meet regardless of any increases or decreases in sales.

Typically, these budgets are for non profit organizations, institutions, or government agencies that have a fixed amount of money to use.

Creation of Your Business Budget

Now that we understand what kind of budget we need, let's dive into the creation of your budget. Although your business might not have all of the answers needed for budget creation, it is okay to make a few assumptions to begin the process of your business budget.

Step 1

Estimated Revenue

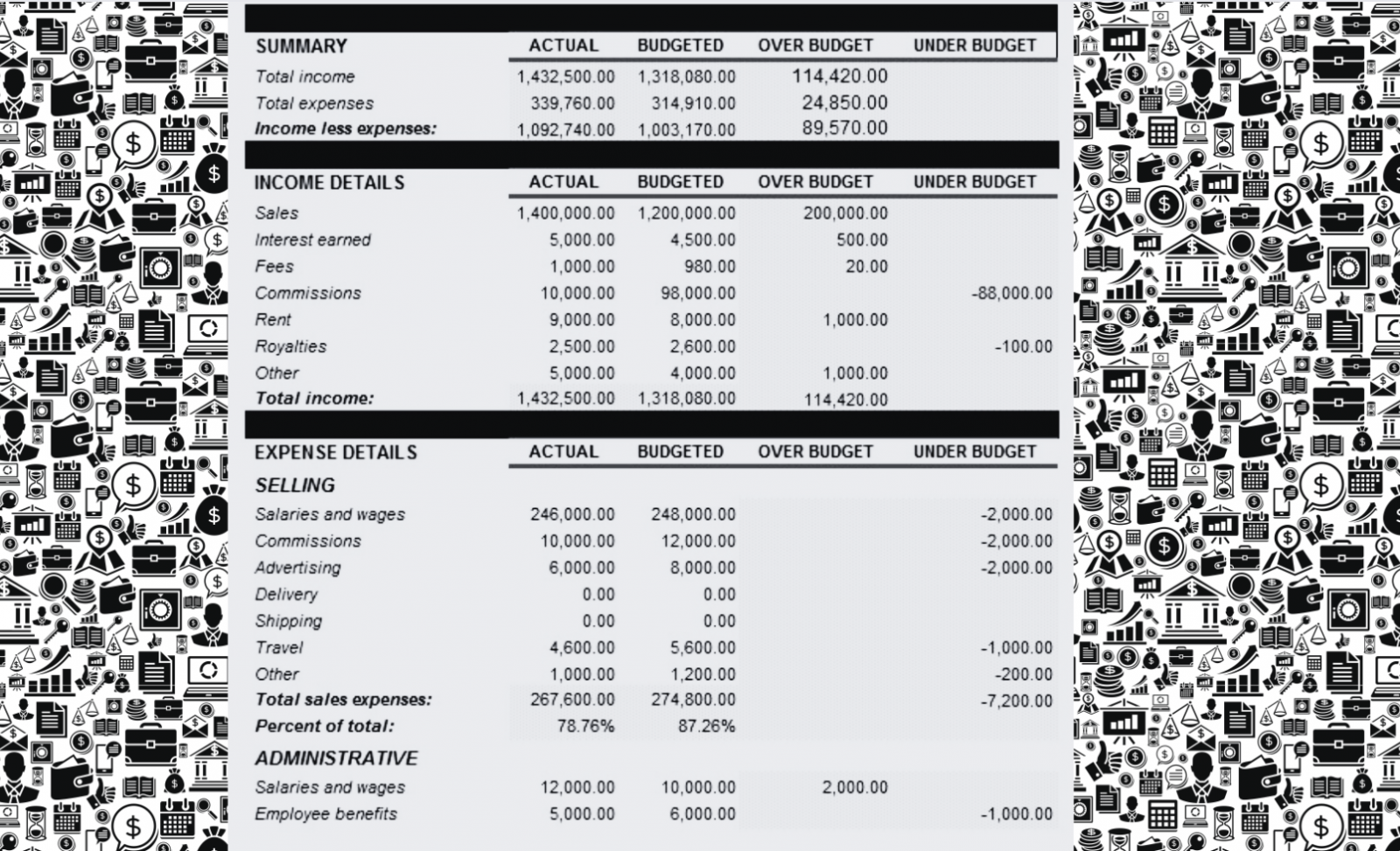

The first step to creating a business budget is to have an estimate of your business revenue. This is the money that you make in total. For this, you can use your sales figures (profit and loss report). After that, you can add in any other income source for your business.

Step 2

Fixed Costs

After you have figured out your combined income, it's time to estimate your business costs.

Fixed costs are any expenses that stay the same from month to month. This can be rent, utilities (ex. internet), marketing, website hosting, and payroll costs.

After you have accounted for all of your expenses, review them. See which costs repeat month to month and then that will determine your fixed costs.

Once you have documented your fixed costs, add them together and then you will have your total fixed costs (expenses) for the month.

Step 3

Include Variable Expenses

After you have noted your fixed costs, next it is time to include your variable expenses.

Variable costs vary month to month based on activity and usage. These costs are things like electricity or gas, shipping costs, or even sales commissions.

Variable costs will always change on a monthly basis. At the end of each month, you should still add up your variable costs. After a few times of these costs recurring, you will be able to predict the costs depending on usage. If your business is busier one month, you will be able to correlate this cost with the previous month resulting in an estimated usage cost.

This will enable you to create a more accurate projection for your budget.

Step 4

One-Time Spends

Now that we have an understanding of our monthly variable and fixed costs, now we can look at the annual or one-time costs. These expenses are costs that occur less frequently. Some examples of these costs include a computer, a business course, a subscription for aggregators, and more.

These costs are very important to remember because they require more than the average, planned budget that you have now created.

You need to remember to set money aside for these business emergencies.

Step 5

Add It Up!

Now that you have thoroughly found, collected, and documented all of your costs, it's time to add them up. On your business budget, you will want to add up all of your total income and your total expenses (All of the expenses above). Next, compare your total income vs. total expenses. Once you see those side by side, compare your profitability after every expense is paid.

All Done!

Congratulations! Now you know how to make a budget for your small business. If you have any questions, please contact us today and let us help you with your marketing budget!